Pay Estimated Quarterly Taxes 2024. April 15, 2024 · 9 min read. Estimated quarterly tax payments are due four times per year, on.

For example, say your gross income for the prior year was $50,000, and it jumped up to $100,000 for the current year. Here is an overview of the quarterly estimated tax.

There Are A Number Of Income Types That Are Subject To Estimated Quarterly Taxes.

Information you’ll need your 2023.

Knowing These Dates Will Help Ensure That You Pay Your Taxes On Time And Avoid Any Potential Penalties.

You can pay by check, cash, money order, credit card, or debit card.

Estimated Taxes Are “Pay As You Go,” According To The Irs, And Are Spread Across Four Payments.

Images References :

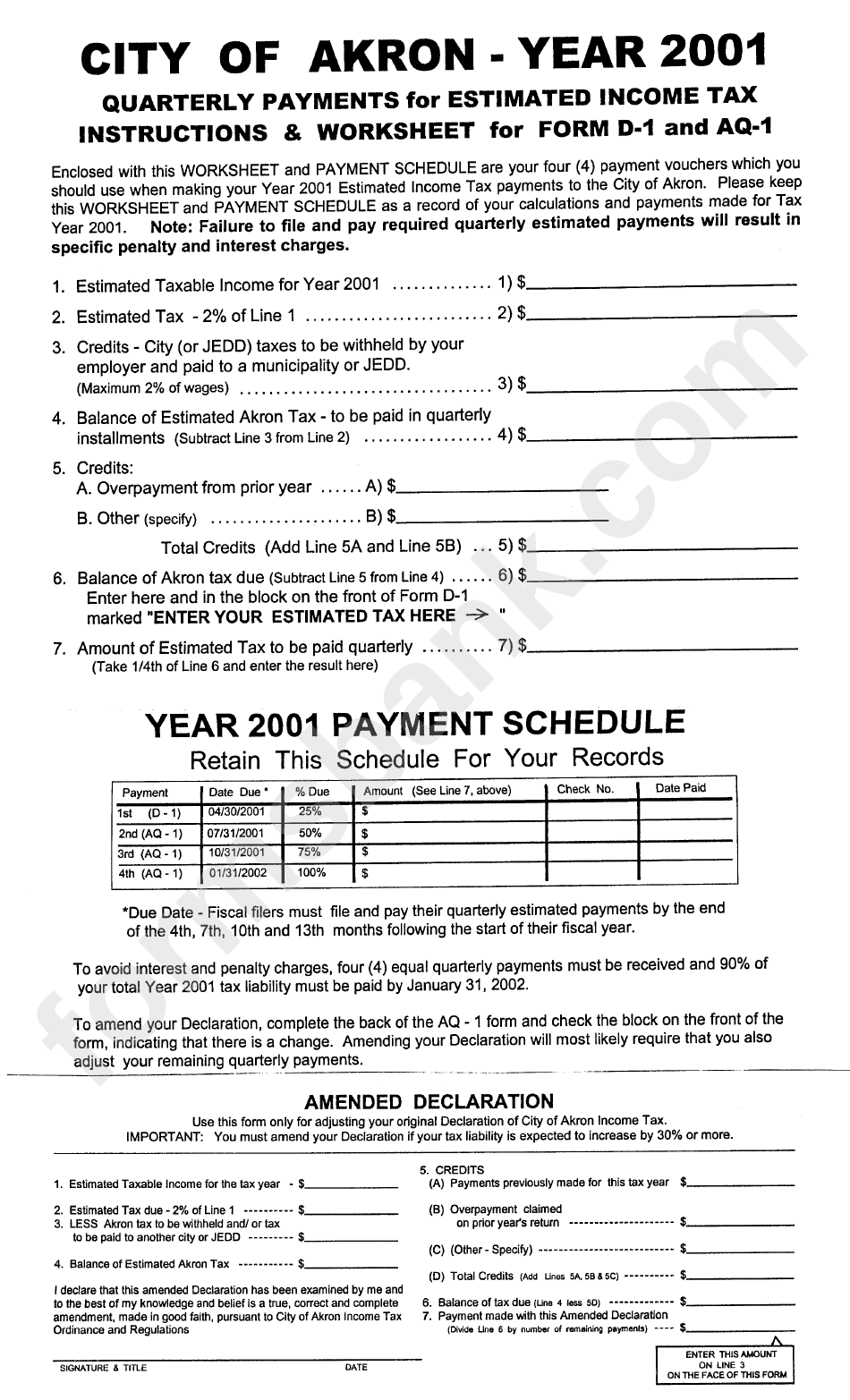

Source: www.formsbank.com

Source: www.formsbank.com

Quarterly Payments For Estimated Tax Form printable pdf download, Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments. This tool takes into account your filing status, dependents, income, and deductions to provide an estimated tax obligation.

Source: www.youtube.com

Source: www.youtube.com

How to Calculate Quarterly Estimated Tax Payments "UNEARNED", You can make your quarterly tax payments. This interview will help you determine if you’re required to make estimated tax payments for 2024 or if you meet an exception.

Source: www.youtube.com

Source: www.youtube.com

How to Pay Quarterly Estimated Taxes YouTube, You can pay by check, cash, money order, credit card, or debit card. If you’re at risk for an underpayment penalty next year, we'll automatically calculate quarterly estimated tax payments and.

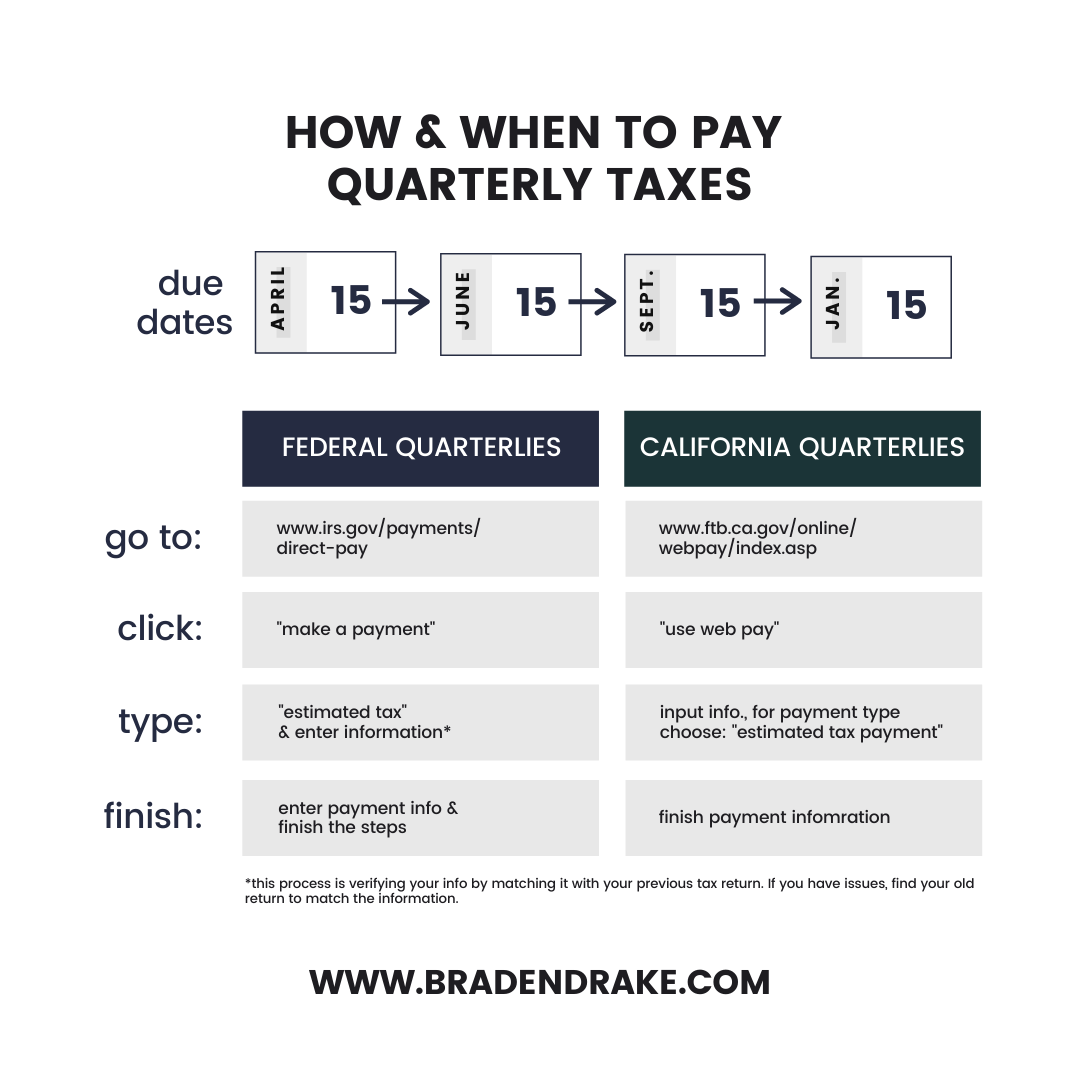

Source: www.bradendrake.com

Source: www.bradendrake.com

How to Calculate and Save Your Quarterly Taxes, How to pay estimated quarterly taxes. The 2024 quarterly estimated tax deadlines are:

Source: gilliganwketti.pages.dev

Source: gilliganwketti.pages.dev

Quarter Tax Dates 2024 Rowe Liliane, If you work and have. If you own rental properties and expect to owe at least $1000 in taxes for 2024, you’ll need to make estimated tax payments quarterly.

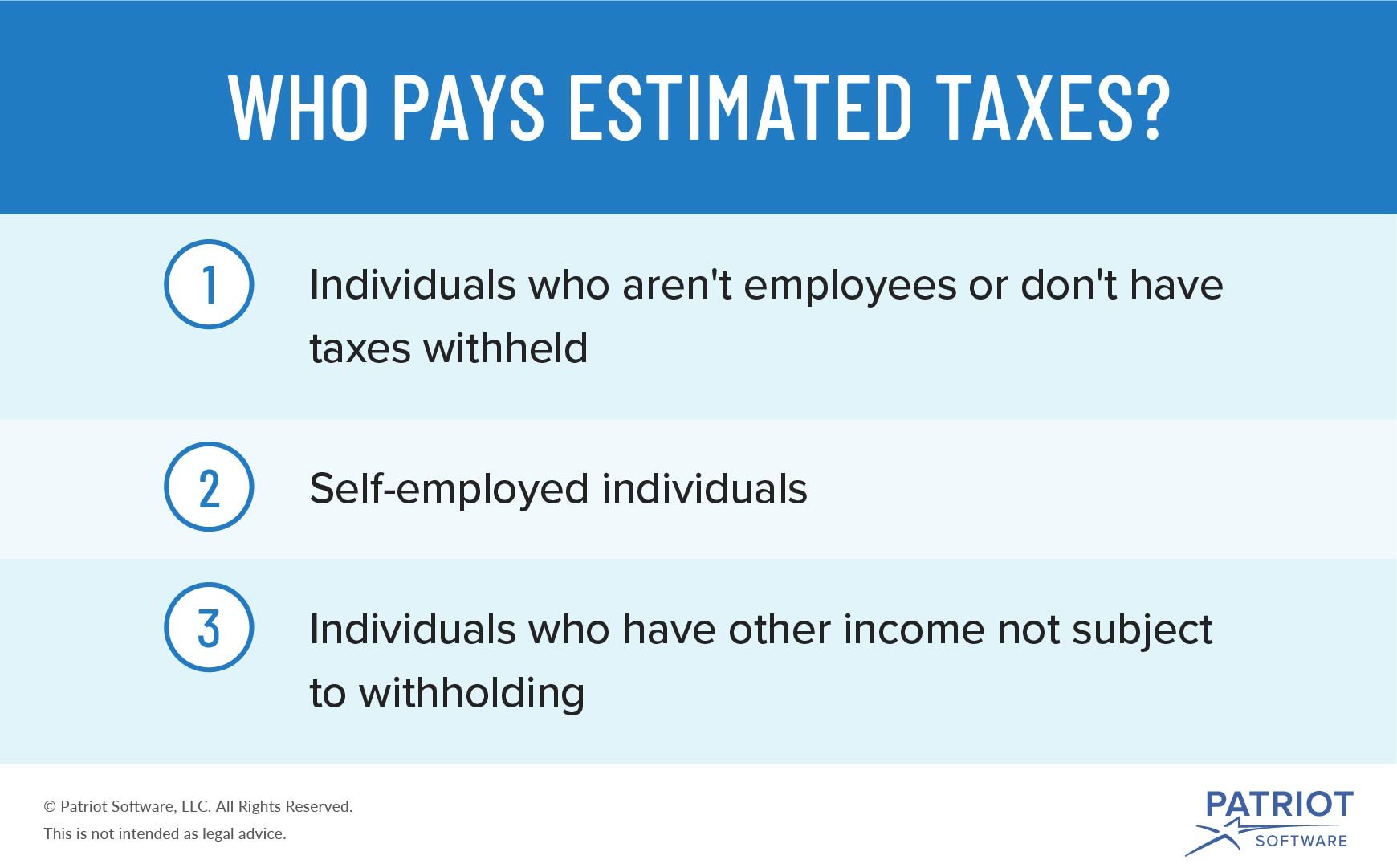

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Is Estimated Tax? Calculations, Penalties, & More, For income earned in 2024, you’ll make three payments in. If you’re at risk for an underpayment penalty next year, we'll automatically calculate quarterly estimated tax payments and.

Source: www.whereverwriter.com

Source: www.whereverwriter.com

Freelancer's Guide to Quarterly Estimated Taxes The Wherever Writer, There are a number of income types that are subject to estimated quarterly taxes. For example, say your gross income for the prior year was $50,000, and it jumped up to $100,000 for the current year.

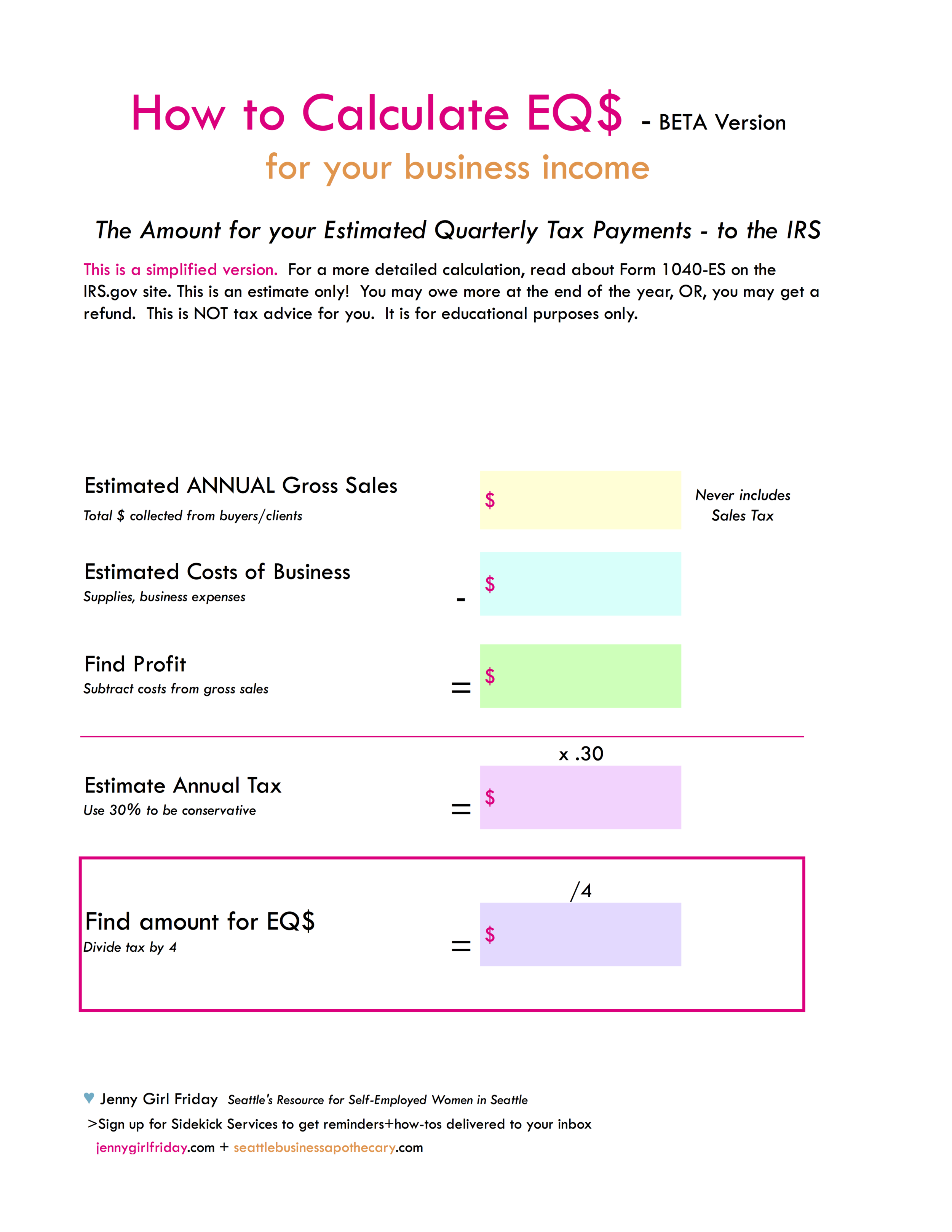

Source: seattlebusinessapothecary.com

Source: seattlebusinessapothecary.com

Estimated Quarterly Payments to the IRS What are they? Do I have to, Estimated quarterly tax payments are due four times per year, on. Who should make estimated quarterly tax payments?

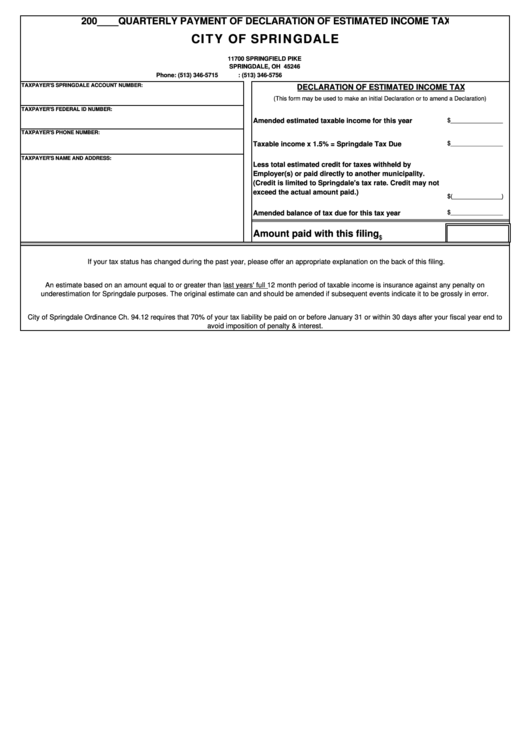

Source: www.formsbank.com

Source: www.formsbank.com

Quarterly Payment Of Declaration Of Estimated Tax Form printable, Who is required to file quarterly taxes? Solved•by turbotax•2193•updated january 30, 2024.

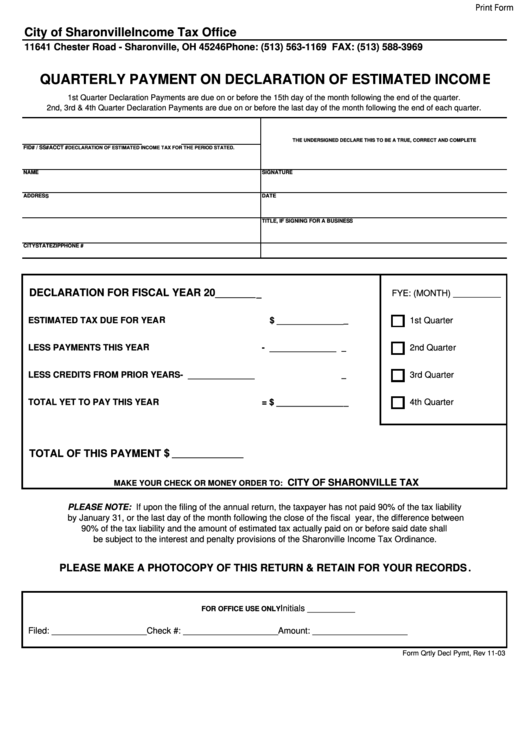

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Quarterly Payment Form On Declaration Of Estimated, Information you’ll need your 2023. For income earned in 2024, you’ll make three payments in.

For Income Earned In 2024, You’ll Make Three Payments In.

For example, if you plan to make $40,000 in ira distributions and have $20,000 in social security income with the standard deduction, your taxes owed will be.

This Irs Publication Covers The.

When to pay estimated taxes for 2024;